Top Gun Retirement

Top Gun Retirement

The Retirement Flight Plan series

Richard “Ace” Goselin

One of my favorite movies and soundtracks is *Top Gun*. Maverick and Iceman are naval aviators with the United States Navy. They fly F-14 Tomcats with their hair on fire, inverted at Mach speeds. When they are not flying, they are playing volleyball on the beach with their shirts off. After years of flying service, Maverick and Iceman are planning retirement from the United States Navy. They each have accumulated one million dollars from years of saving.

Their investment approaches are as different as their characters. Always living on the edge and being “dangerous”, Maverick has invested heavily in equities, believing that over time, he stands to earn a higher rate of return. History suggests he might be right. His average investment return was 8%.

Iceman on the other hand, is no stranger to machismo but opts for a portfolio likely to produce a lower, more consistent rate of return. Like flying, he prefers to be ‘Ice Cold’ and consistent, with no mistakes. His average investment return was 6%.

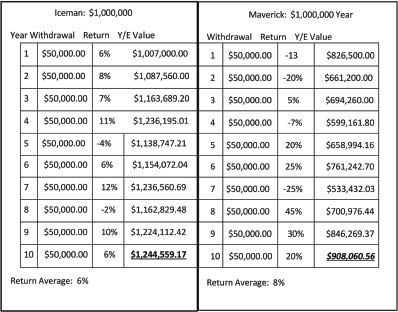

Starting with one million dollars each, they both desire to withdraw $50,000 per year to supplement their Navy retirement checks. They retire at slightly different times with different investment approaches. Iceman retires with a diversified and well-balanced portfolio during a time of relative calm in the markets. Maverick, with a more volatile portfolio in stocks, retires just as a downturn hits the markets, similar to the Great Recession in 2007 or just after the pandemic in 2021. Volatility can take a huge toll on the portfolio, especially in the initial years of retirement where negative returns can take years to recover. Let’s take a look at how they each did.

Timing Matters: Understanding Sequence-of-Returns Risk

One critical concept in retirement planning is sequence-of-returns risk. This refers to the risk that a market downturn occurs right as you retire, significantly impacting your portfolio's returns, especially if it lasts for multiple years. This risk is particularly concerning for equity-heavy portfolios like Maverick's, where early losses can be difficult to recover from.

As seen in the table below, Maverick did earn a higher average return (8% vs. 6%) at the end of ten years, however he has considerably less money (minus $300k) than his Top Gun wingman, Iceman. Both started retirement with one million dollars and planned to withdraw $50,000 a year. While Iceman earned a 6% rate of return, Maverick earned 8%, but Iceman's ending balance was $1,244,599 compared to Maverick’s $908,060.

The first two years saw negative returns for Maverick, making it difficult to recover from this negative sequence-of-returns. By minimizing his potential downside, Iceman ended up with more money, even though he averaged a lower return over time.

Note: This phenomenon exists only because Maverick and Iceman need to sell shares for cash during retirement. Had they never needed to sell shares, then Maverick would have more money than Iceman, despite the volatility. This is the Math of Retirement and Sequence-of Returns risk.

Risk Management

Pilots face risks every day, they develop techniques to mitigate these risks.

Retirement has its own unique risks such as longevity, inflation, volatility of returns, sequence-of-returns and many more. These risks can ruin a retirement and possibly make it unable to recover.

GSI Financials has developed retirement plan models to mitigate each of these risks. For sequence-of-return risks there are ways to reduce the risk. One effective approach is Time-Segmentation, also known as a Retirement “Bucket” strategy to bridge the early years of retirement.

Time-Segmentation (Bucket Approach) Model: Is an income distribution plan that provides a balanced combination of safe and more volatile investments to achieve long-term retirement goals. Investments are divided into various segments (accounts) with each segment responsible for providing income for a specific time period of an individual’s retirement. The objective of time-segmented distribution plan is to match the retiree’s current investments with their future income needs.

For example, you might use ultra-conservative investments such as CD’s, Treasury Bills, along with conservative investments like bond ladders to create “buckets” that ensure money for the first 3-5 years of retirement. This bridge bucket protects the rest of the portfolio from withdrawals during this potentially volatile time.

The 3–5 year time period is often enough to ride out the volatility of a bear market during the initial retirement years, while providing a guaranteed income bridge through ultra-conservative investments.

GSI Financials Value Proposition:

To partner with you in achieving the best retirement possible by taking the time to clearly understand your needs and objectives, while offering transparency as a fiduciary regarding costs and compensation. Schedule Your Complimentary Meeting.

There are many financial advisors that create many financial plans…..There is only one Retirement Plan that’s Right for You.

GSI Financials can develop a holistic retirement plan that’s “Right for You” based on your preferences, goals and objectives.

Take Complementary Retirement Questionaire

Have a Question? Want to have a Consultation?

Find us on our website or email:

www.gsifinancials.com