Retirement Income That Matches Your LifeStyle

What is Your Retirement LifeStyle?

A successful Retirement Income Plan starts with determining your Retirement Lifestyle goals.

What are your retirement goals?

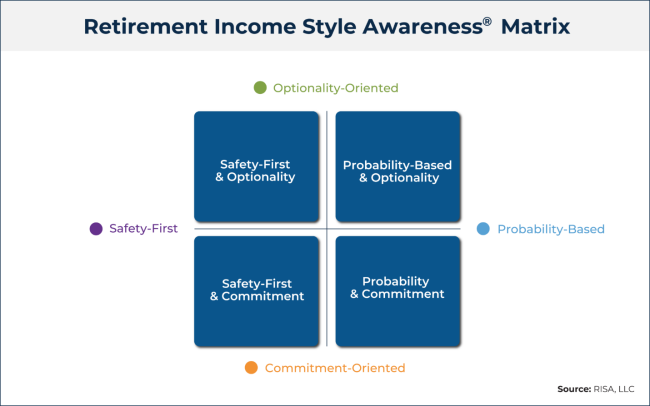

GSI Financials uses proprietary software, the Retirement Income Style Awareness (RISA), to determine your retirement lifestyle goal. We align your retirement lifestyle goals with your retirement income plan. This RISA profile has been tested and quantified into four separate and distinct retirement income styles.

Knowing your Retirement LifeStyle allows GSI Financials to align your retirement lifestyle with an Income plan that’s right for You.

There are 4 Retirement Income Style Preferences:

Safety-First vs. Probability-Based

&

Commitment Oriented vs. Optionality Oriented

Building a successful retirement income plan involves matching your retirement lifestyle with your retirement assets. Determining the best method and tools to create a retirement income stream to achieve your retirement goals while protecting against the unique risks of retirement.

Developing a retirement income strategy that aligns with your goals and style allows for the freedom and flexibility to focus on your interests and passions after a lifetime of work.

Retirement Income Optimization

Primary Factors that Identify your Retirement Income Style:

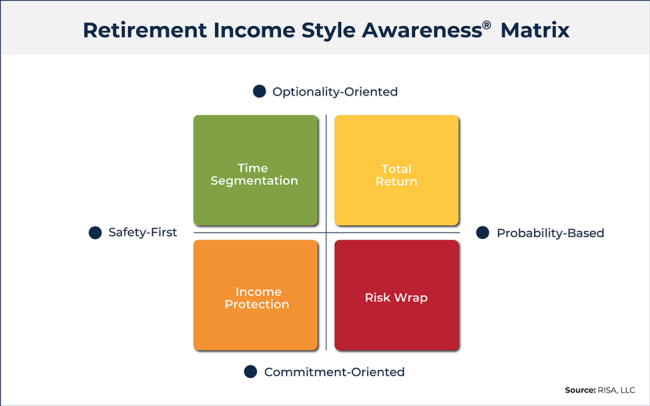

While there are many approaches to creating retirement income, there are 4 main income strategies, largely defined by how each aligns with your Retirement Income Style.

Once you determine your Retirement Income Style Awareness (RISA), there are 4 corresponding Retirement Income Strategies:

- Total Return Strategy

- Income Protection Strategy

- Risk Wrap Strategy

- Time Segmentation Strategy

Total Return (probability-based & optionality) produces income by spending systematically from a diversified investment portfolio focused on total returns (think: the 4% rule).

Income Protection (safety-first & commitment) builds a lifetime income floor with secure income sources such as Social Security and simple income annuities to support spending.

Risk Wrap (probability & commitment) pairs secure income sources to create an income floor wrapped around a diversified investment portfolio to generate retirement income.

Time Segmentation (safety-first & optionality) matches short-term spending needs with secure assets and long-term spending needs with less secure assets to generate income.